ct sales tax exemption form

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. In Connecticut certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

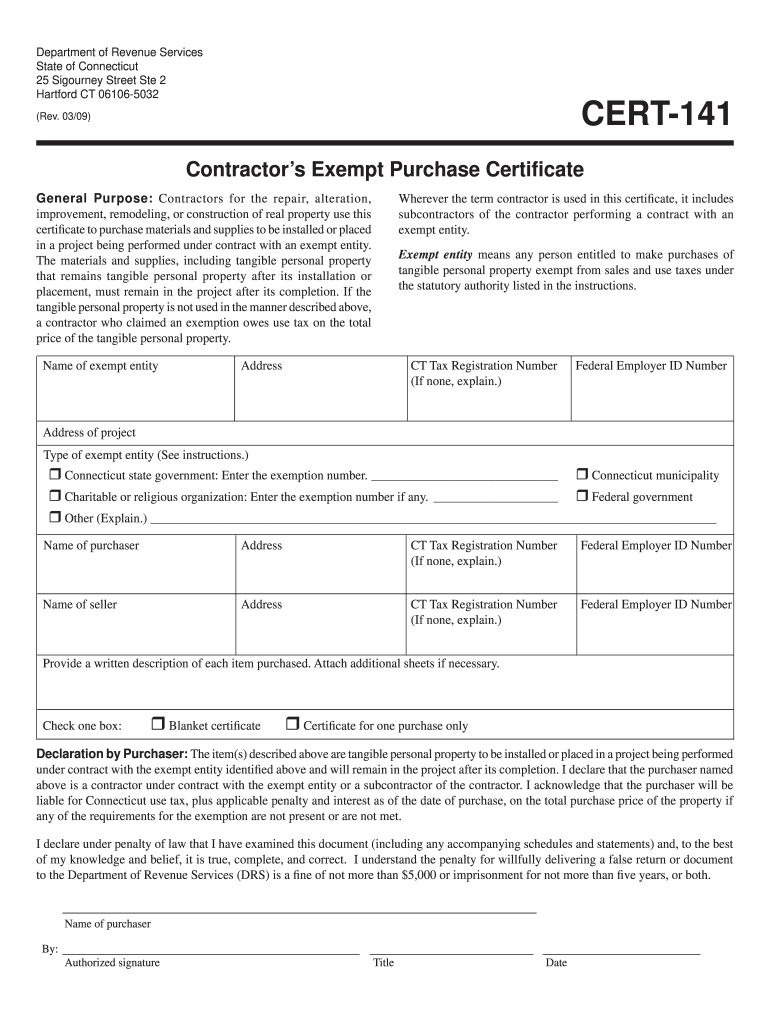

Form Cert 141 Fillable Contractors Exempt Purchase Certificate

These taxes apply to any item of tangible personal property unless the law expressly exempts it.

. Sales and Use Tax Exemption for Purchases by Qualifying Governmental Agencies. Dry Cleaning Establishment Form. How to use sales tax exemption certificates in Connecticut.

2022 Connecticut state sales tax. Exact tax amount may vary for different items. An organization that was issued a federal Determination Letter of exemption under Section 50lc3 or 13 of the Internal Revenue Code is a qualifying organization for the purposes of.

Table 1 lists the. The purchaser must complete CERT-125 Sales and Use Tax Exemption for Motor Vehicle or Vessel Purchased by a Nonresident of Connecticut Conn. Applying for a Sales Tax Permit Resale Number Retailers Advertisements.

You can download a PDF of the Connecticut General Sales Tax Exemption Certificate Form CERT-100-B on this page. To obtain a Connecticut sales tax exemption. 44 rows Form Inst.

I further certify that if any property so purchased tax free is used or consumed by the firm as to make it subject to a sales or use tax we will pay the tax due direct to the proper taxing authority. Vendors at Flea Markets. Ad Download Or Email CT JD-CV-3a More Fillable Forms Register and Subscribe Now.

A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Sales Tax Exemptions in Connecticut. Exemption from sales tax for services.

Factors determining effective date thereof. A signed copy of Sales Tax Exempt Purchaser Certificate Form ST-5 or Contractors Sales Tax Exempt Purchase Certificate Form ST-5C and. Admissions and Dues Taxes Form.

Ad Download Or Email CERT-141 More Fillable Forms Register and Subscribe Now. Printable Connecticut Purchases of Tangible Personal Property and Services by Qualifying Exempt Organizations Form CERT-119 for making sales tax free purchases in Connecticut. Certificate A - California Sales Tax Exemption Certificate Supporting Bill of Lading.

Connecticut General Statutes - Section 12-41263. Obtaining a Duplicate Sales Tax Permit. Rental Surcharge Annual Report.

Certificate B - Certificate Supporting Bill of Lading California Blanket. Connecticut State Department of Revenue Services. You can download a.

Child Tax Rebate - A new child tax rebate was recently authorized by the Connecticut General Assembly click here to learn more. Manufacturing and Biotech Sales and Use Tax Exemption See if your manufacturing or biotech company is eligible for a 100 or 50 tax exemption. Reduced Sales and Use Tax Rate for Motor Vehicles.

Online Filing - All sales tax returns must be filed and paid electronically. Sales and Use Tax Forms. Please visit the Filing and State Tax section of our website for more information.

Materials tools fuels machinery and equipment used in manufacturing that are not otherwise eligible for a sales tax exemption 50 of the gross receipts from such items 12-412i. We offer a broad product selection value added services manufacturing solutions. Ad The Semiconductor Lifecycle Solution the worlds largest source of semiconductors.

Sales tax or 2 outside Connecticut for use here ie use tax. CT Use Tax for Individuals. Exemption from sales tax for items purchased with federal food stamp coupons.

Several exemptions are certain. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. Health Care Provider User Fees.

Exemption permits must be renewed every two years. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Connecticut sales tax. You can download a.

The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is. A copy of the. If approved form OR-248 Agricultural Sales Tax Exemption Permit is issued.

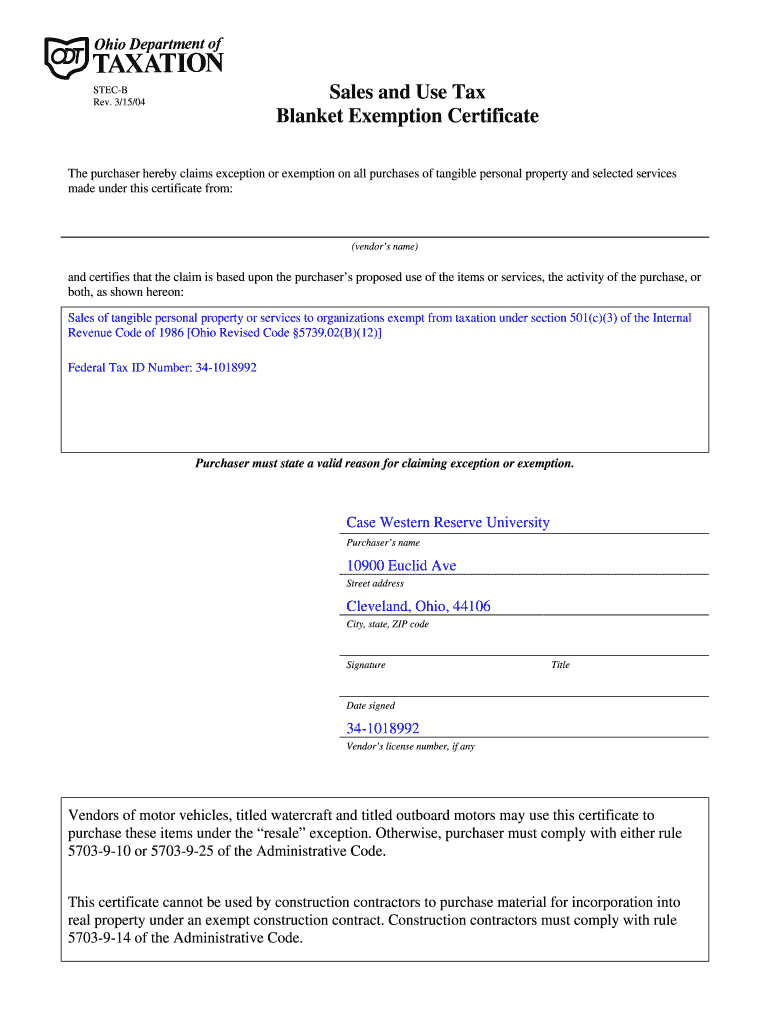

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Credit Applications Tarantin Industries

King Soopers Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Form Ct 205 Fillable Cigarette Tax Reconciliation Form File Online Using Tap

Sales Tax Exemption For Building Materials Used In State Construction Projects

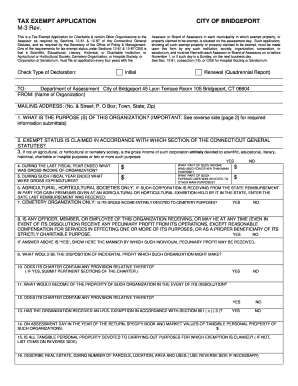

Tax Exempt Form Pdf Fill Out And Sign Printable Pdf Template Signnow

Form Reg 8 Fillable Farmer Tax Exemption Permit

Form Cert 126 Fillable Exempt Purchases Of Tangible Personal Property For Low And Moderate Income Housing Facilities

Ct Drs Cert 141 2009 2022 Fill Out Tax Template Online Us Legal Forms

Form Ct 206 Fillable Cigarette Tax Exemption Certificate

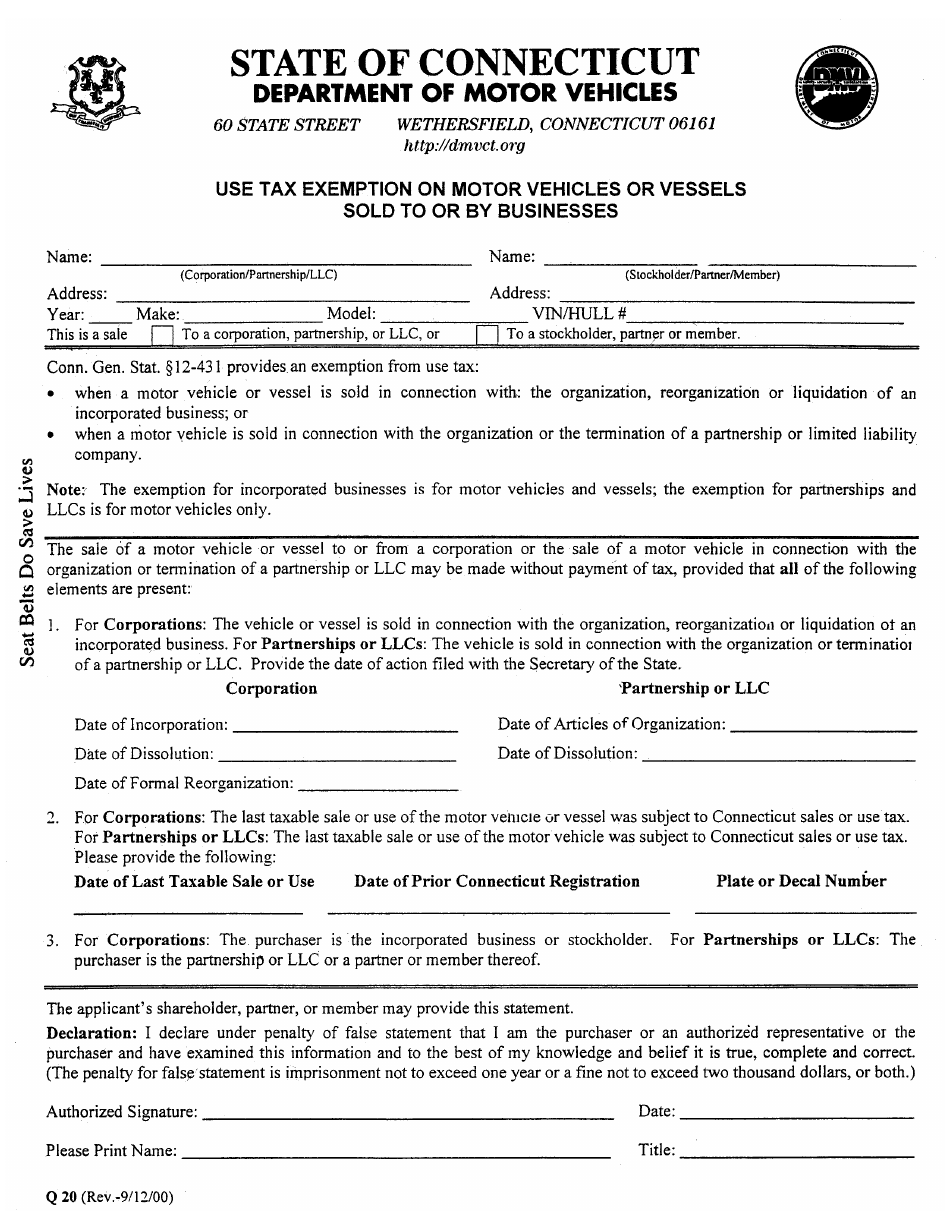

Form Q 20 Download Fillable Pdf Or Fill Online Use Tax Exemption On Motor Vehicles Or Vessels Sold To Or By Businesses Connecticut Templateroller

Businessusetaxexemptform Motion Raceworks

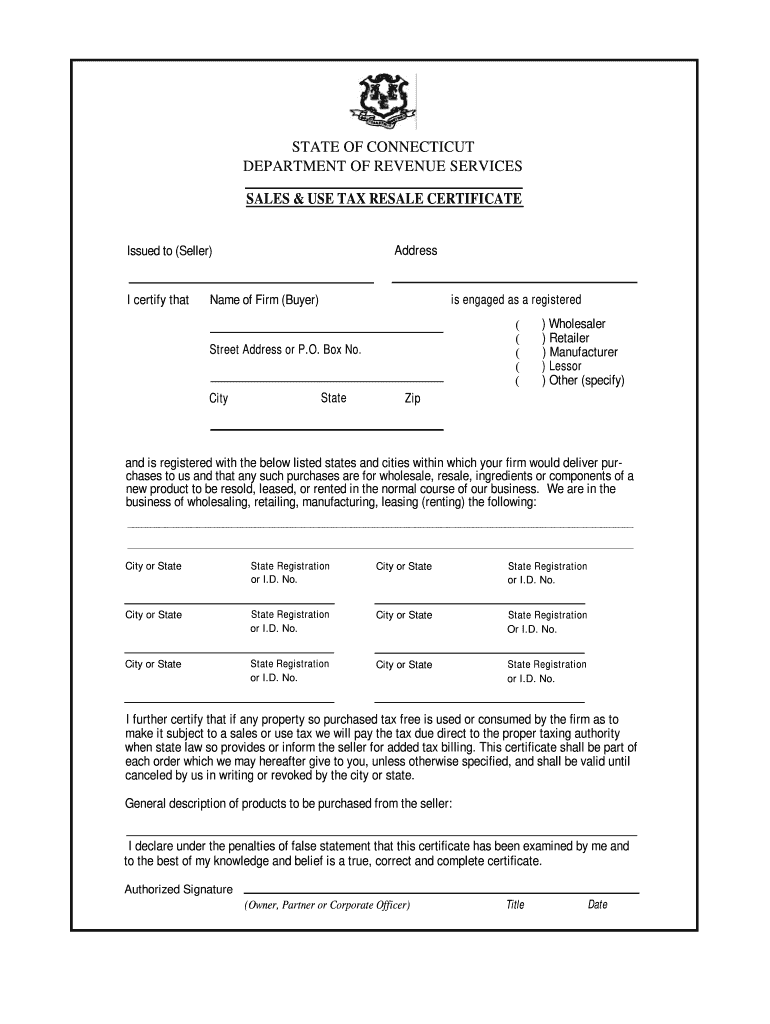

Ct Sales Use Tax Resale Cerfiticate Fill Out Tax Template Online Us Legal Forms

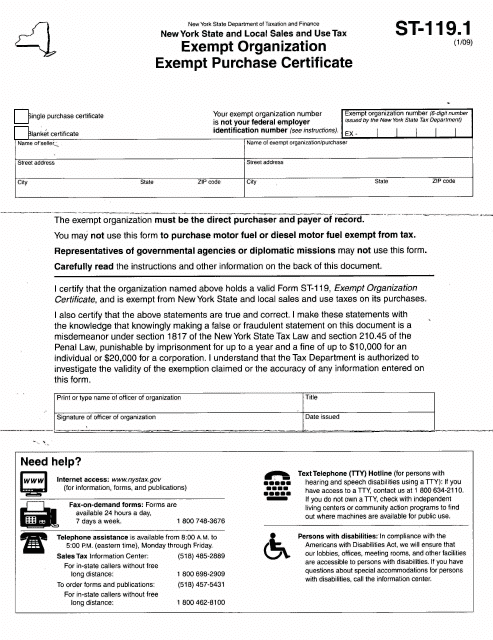

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate New York Templateroller